According to PWC, rural India accounted for nearly 70% of India’s population but contributed only 17% to pharma industry’s revenues in 2016. For a long time, pharma companies have focussed on urban markets for growth, with forays into rurban (non-metros, mid-sized towns, villages) regions being limited to acute therapies. But rurban healthcare landscape is evolving, compelling them to cast a fresh eye on this potentially huge market segment. How can they make the most of this opportunity?

Why Pharma chooses India over Bharat

- Poor healthcare infrastructure – Rurban areas severely lag in number of doctors and healthcare facilities. Only 1/3rd of all hospital beds are found in rural areas. Diagnostic services are hard to access.

Poor literacy levels and misconceptions about vaccines and modern (read western) therapies discourage rural patients from visiting primary health centers and doctors’ clinics. Often, faith-healers and quacks are consulted first, leading to delayed diagnosis and worsening of ailment.

- Low affordability – A significant number of rural patients are daily wage-earners. They often amass huge debts due to expenditure on prolonged illness. Private health cover is a rarity and state-sponsored insurance is insufficient, applicable only to inpatient treatment. Generics are the only drugs consumed and sometimes even these are stopped mid-course. Sale of spurious and counterfeit drugs is rampant.

- Logistical issues – Pharma’s conventional distribution system (company->C&F agents->stockist->wholeseller->retailer) fails to work in the rural setup as it is hard to find financially strong business partners at each stage of the supply chain. Therefore, the distribution network is patchy and storage facilities below par.

- Inadequate marketing bandwidth – Employing huge armies of MRs to continuously engage with rural doctors does not make business sense to Pharma. Most physician and patient engagement initiatives are half-hearted and sporadic.

Despite these negatives, this market segment is transforming. A report by McKinsey pegs rural India to account for 25% of the total healthcare market by 2020. This attributes to the slow but inevitable change happening in this region, driven by rising income levels, higher incidence of chronic illnesses, better medical infrastructure, among other factors.

Evolving Rurban Healthcare Landscape – Creating Opportunity for Pharma

- Changing Demography – As per the Census of India statistics, a large part of rurban areas in the country is not stand-alone settlements anymore but connected to other parts due to increased transport and internet. These small towns form a part of a cluster that holds potential for growth. Studies suggest a large influx of villagers settled in mid-size towns (population>50k) and very large villages (population>5k). Rurban inhabitants are also more literate now, with literacy levels crossing 71% in 2015 as per studies by NSSO. They also witness increased disposable incomes, upto 54% in this decade (2010-2020). This suggests that patients who have been buying only generic drugs till now may be able to upgrade to pricier brands in future.

- Rising Disease Burden – Lacking access to clean water and sanitation, rurban regions have always been at higher risk of various communicable diseases. Studies now indicate that the burden of lifestyle diseases is also on the rise, thanks to epidemiological transition caused by urbanized lifestyles and rising life expectancy. By 2025, hypertension, diabetes and cardiovascular patients in rural areas are expected to rise from 15% to 25%, 5% to 8%, and to >30% respectively.

- Govt. Initiatives – The government flagship program “National Rurban Mission” (NRuM) aims to improve rural healthcare. This thrust would mitigate infrastructural hurdles to an extent and also create opportunities to reach the underserved patient populace. Health coverage through Rashtriya Swasthya Bima Yojana will further enhance affordability and enable rural patients to be treated for serious illnesses and higher cost procedures.

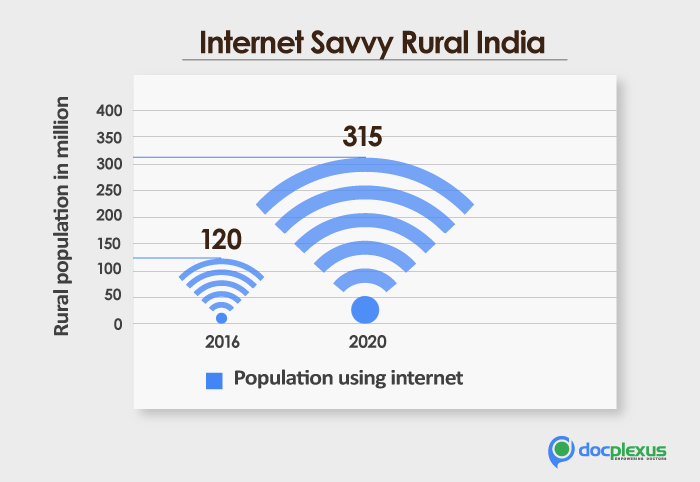

- Technological Empowerment – A burgeoning middle class and modern communication technology has led to a dramatic rise in rural internet users. Around 70% of rural consumers use the internet primarily for social networking. Education and technology have enhanced the understanding of rurban population towards medical science.

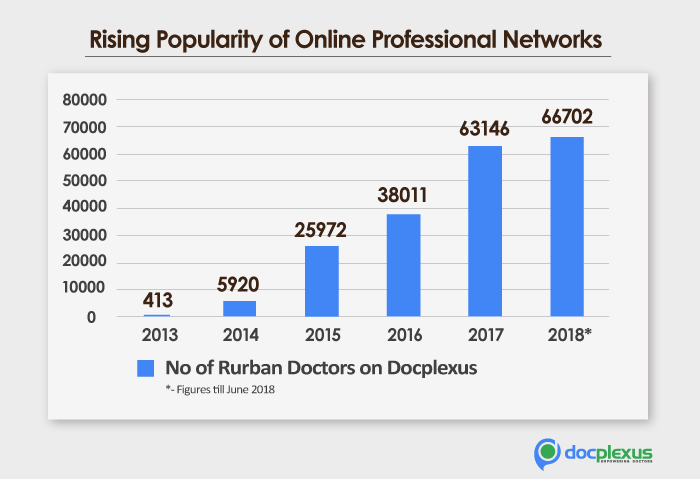

- Digitally-connected Doctors – Digitization is revolutionizing the way doctors in rurban areas communicate and consult. Telemedicine, EHR/EMR, online professional networks and other digital solutions are empowering them to improve medical outcomes despite existing challenges. Rurban doctors can now fill the knowledge gap between them and their urban counterparts. They can connect to specialists and superspecialists and consult with them on complex cases. They can sign up for online CME courses that help them complete the mandatory learning at their convenience, without disturbing their practice and traveling to metros, saving both expenses and time. Docplexus notes a steady rise in users from rurban regions. Currently, close to 30% of our users hail from Tier 3 and Tier 4 towns.

Prescription for Pharma’s Rural Success

To leverage opportunities in rural markets, Pharma must adopt a multipronged strategy and unlearn set ways of market penetration.

- Customize offerings – Given the price-sensitive nature of the market segment, affordability should be the biggest consideration while strategizing growth. Appropriate pricing and packaging can increase affordability and boost market share.

- Understand doctors’ specific pain points – Non-compliance to treatment duration and modality is a common problem for doctors in rural regions. Pharma can help by developing patient education programmes and supporting literature to improve adherence. Presence on online communities like Docplexus can lend Pharma key insights into the needs of the rurban healthcare customers. This will help them strategize better and bring out solutions that are most suitable for those geographies.

- Break away from norm – Strategies that work for urban markets may prove complete failures for rural, necessitating a whole new approach to market penetration. Mankind Pharma and Alkem have convinced chemists to turn into stockists and offer free samples to doctors. A ‘piggyback’ distribution model where pharma rides the distribution channel of a carrier (e.g. an FMCG company) can provide last mile access. Contract field force can be employed to engage with doctors. Mobile pharmacy vans and distribution of OTC drugs through post offices are other innovative ways to tap the remotest corners of the market.

- Engage with patients – Medical camps can help spread health awareness and education among locals. Some existing initiatives include Arogya Parivar (Novartis), Sanjeevani (Pfizer) and SEWA/SHG (Eli Lily). These are for-profit social initiatives for educating and training the rural population.

- Partner with state & payors – Active participation of Pharma in PPP models can improve healthcare access. Pharma could also partner with payors to provide lifesaving but pricey therapies.

- Mobilize healthcare fraternity – Training can be imparted to paramedics, chemists, nurses and other healthcare workforce groups through webinars, seminars and workshops. Pharma can associate with local hospitals and healthcare centres to define treatment protocols and initiate clinical studies at local level.

While opportunities in rurban India are aplenty, whether Pharma is able to leverage them will depend on how well it understands the peculiarities of the market and adopts innovative practices to overcome existing challenges.