Hearing impairment is currently the most common sensory deficit in humans. As per the latest WHO report published in April 2021, around 432 million adults and 34 million children throughout the world suffer from hearing loss and require rehabilitation. Although several hearing aids & implants are currently available, affordable yet technologically advanced devices are still not available for people with hearing loss.

The present article dives deep into the market dynamics of hearing devices, identifies the major gaps & suggests the way forward for medical device companies.

Key Industry Insights

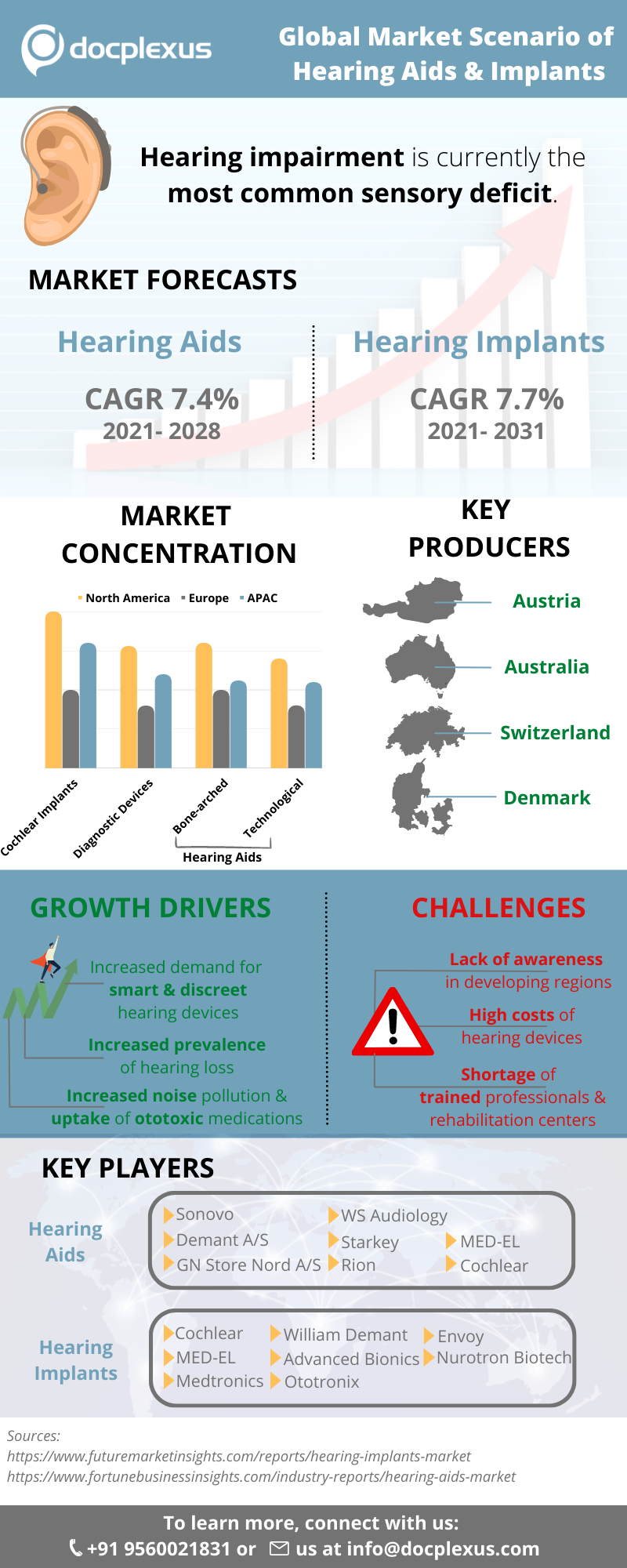

The infographic below presents some key highlights of current and future market prospects of hearing devices (aids and implants).

Hearing loss has been often termed as “invisible disability”, not just because of the lack of visible symptoms, but because it has lot of stigma associated and is ignored by government and policy-maker.

An analysis of the study reveals that there is a fair scope of investment for medical device firms in the hearing aid and the bone conduction implant market. Additionally, as far as the growth rate is concerned, the hearing implant segment is expected to register a comparatively higher compound annual growth rate (CAGR) of 7.7% than its counterpart (i.e., the hearing aid at 7.4%).

As per the WHO, around 700 million people are expected to suffer from hearing loss by 2050. This along with the growing number of health initiative programs by respective governments across the globe, including India (i.e. launch of the National Program for Prevention and Control of Deafness) is acting as one of the major drivers to increase the revenue share of the hearing device market.

While results from the present market scenario hold great promise for the future, there are some key restrains that one needs to take care of while planning to grow in this market. The restraining factors include high cost and lack of awareness in developing countries for hearing devices.

Nevertheless, newer opportunities (increasing demand for wireless, smart and discreet hearing aids) and market trends as strategic acquisitions and mergers are sure to give the hearing device market a boost during the forecast period.

Future Directions

By Product

1) Cochlear Implants (CI)

Such devices are generally aimed to treat individuals with severe to profound sensorineural hearing loss and who lack cochlear hair cells. In developed countries, most-technologically advanced bilateral cochlear implants are used by the patients because of availability of medical-insurance. However, in developing countries like India, unilateral cochlear implants form the cornerstone for the treatment of such individuals.

Since both the ears are in the normal hearing process, a unilateral CI has its own shortcomings when it comes to effective sound localization. Also, the external speech processor in a CI needs to be upgraded after a fixed time because of wear & tear of the device, technological advancement and growing hearing or social needs of the patient.

Innovations by medical device stakeholders can further the expansion of a cost-effective bilateral CI while at the same time minimize trauma during its implantation.

2) Bone Conduction Devices (BCDs)

BCDs are indicated either for those who suffer from conductive and mixed hearing loss or for those who have single-sided deafness. Recent market trends have shown that BCDs have a meagre market revenue share when compared to that of CIs. Such a reduced market share can be explained by the challenges faced in the development of a device that would –

- Be powerful enough in terms of efficacy.

- Have a good and long-term stable attachment.

- Be minimally invasive (in terms of attachment of BCDs).

- Be compatible with MRI procedures.

Innovators of medical devices should aim to develop devices that would effectively address the challenges faced by the currently available bone conduction devices.

3) Brainstem Implants (ABIs)

The auditory brainstem implant (ABI) was first developed over 50 years ago for patients with inadequate auditory nerve function. Since then, these implants have undergone considerable innovations in terms of the external speech processor and receiver-stimulator technology. Despite these advances, several challenges remain as far as features of an ideal ABI is concerned. A key constraint in the use of ABI is their often highly variable and unpredictable audiometric outcomes, as some patients achieve speech perception while others don’t (experience limited sound and speech recognition).

Medical device firms can work towards the advancement of ABIs which would show less interpatient variation and help its users achieve an optimal perception of sound and speech.

4) Hearing Aids

Over the past few years, there have been considerable improvements in hearing aids technology. In this regard, one of the major achievements was the introduction of digital hearing aids which could take complex decisions about processing sounds from its surrounding environment. Since then, various strategies which could further revolutionize hearing aids have been evolving. Some of these strategies which are recently in research pipeline include –

- Minimization of background noise and occlusion effect along with maximizing of speech understanding.

- Introduction of wireless systems.

- Smartphone connectivity, thus allowing users to hear conversations while on the phone and also to adjust their hearing aid to different circumstances.

- Mobile applications for allowing users to communicate with their doctors and receive adjustments to their hearing aids without an office visit.

- Fall detectors, as people with hearing loss have an increased risk of falling.

- Language translators which can allow a person with hearing aid to translate voices to their native languages in real-time.

Companies keen on investing in hearing aids should focus on the modernization of the currently available hearing aid portfolio based on the above strategies. This would help them to gain a stronghold of the ever-growing hearing aid market.

By Types Of Patients

The prevalence of hearing loss increases with age, among those older than 60 years, over 25% are affected by disabling hearing loss. Due to the high incidences of auditory impairment in the elderly population, the adult hearing segment is likely to grow at a higher CAGR than the pediatric segment.

On the other hand, the global paediatric segment is expected to grow at a slower rate than its counterpart owing to reasons such as increased acceptance of alternatives, and the temporary nature of hearing loss in such patients.

Additionally, nearly 80% of people with moderate-profound hearing impairment reside in low and middle-income countries including India, China and others. Thus, prospective manufacturers should focus their resources more on the evolution of cost-effective devices aimed at treating the adult segment of the population.

Conclusion

In a nutshell, while the current market situation holds great promise for future growth, hearing device players should be vigilant enough to consider the market restrains and be open to new ideas (like the introduction of AI in hearing devices) while planning their future products in the hearing devices space.

Takeaways for stakeholders:

- Efforts to minimize trauma during implantation of cochlear implants are a priority.

- Brainstem implants with less interpatient variations required.

- Urgent need to modernize currently available hearing aids portfolio.

- More cost-effective hearing devices for adults are needed.

References

- WHO global estimates on prevalence of hearing loss [Internet]. World Health Organization. [1st April 2021].

- Future Market Insights Report [Internet] 2021

- Market Research Reports. [Internet]. Mordor Intelligence. Market study from 2018-2026.

- Market Research Reports. [Internet]. Reports and Data 2021

- Market Research Report. [Internet]. Fortune Business Insights 2022.

Docplexus is the largest digital network of doctors in India with over 3,80,000+ verified doctors, known as a trusted marketing partner for pharmaceuticals & medical device companies. Docplexus empower industry partners to meaningfully engage with the medical community through data-driven, evidence-based marketing & brand management solutions such as Infocenters, Mindset Analysis, KOL Webinars, Sponsored Medical Updates, Accredited Online CMEs & more.